How to Negotiate Medical Bills After Retirement

As you navigate retirement on a fixed income, managing healthcare costs becomes a significant concern. Medical bills can quickly accumulate, creating financial stress. However, you possess the power to challenge and reduce these expenses through effective negotiation. This guide provides actionable steps and practical strategies to help you negotiate medical bills, protect your assets, and maintain your financial security.

Understanding your rights and options empowers you to reduce healthcare costs. You are not alone in facing high medical expenses, and many resources exist to support you in securing fair pricing for your care.

Understanding Your Medical Bills

The first step in medical bill negotiation involves understanding exactly what you owe and why. Medical billing can seem complex, with numerous codes, services, and charges. Taking the time to decipher these documents is crucial before you attempt to reduce healthcare costs.

Review Your Explanation of Benefits (EOB)

Your insurance company sends an Explanation of Benefits, or EOB, after you receive medical care. This document details the services the provider billed, the amount the provider charged, what your insurance covered, and your remaining responsibility. The EOB is not a bill, but a summary of what your insurer processed. Compare your EOB with the actual bill you receive from the provider. Look for discrepancies between the services listed on your EOB and the services you actually received. For instance, if your EOB shows a charge for an overnight stay, but you only had an outpatient procedure, that signals a potential error.

Obtain an Itemized Bill

Never rely solely on a summary statement. Request a detailed, itemized bill from the hospital or clinic. This document breaks down every single charge, often by procedure, medication, supply, and date. For example, a single surgery might list charges for the surgeon’s fee, anesthesiologist’s fee, operating room time, individual sutures, pain medication doses, and even disposable gloves. Examining an itemized bill helps you identify potential overcharges, duplicate billing, or services you did not receive. If you see a charge for a $50 bandage, that is a red flag for medical bill negotiation. Many providers charge significantly more for common items than their actual cost.

Common Billing Errors to Look For

- Duplicate Charges: Services or items billed multiple times.

- Incorrect Codes: Billing codes that do not match the services rendered or upcoding, where a more expensive service code is used for a simpler procedure.

- Canceled Services: Charges for tests or procedures that were ordered but ultimately not performed.

- Incorrect Dates of Service: Charges for services on dates you did not receive care.

- Unbundled Charges: Billing for individual components of a service that should be included in a single, comprehensive charge.

- Incorrect Patient Information: Errors in your name, insurance ID, or policy number, leading to claim rejections or incorrect billing.

According to Medicare.gov, you should always review your Medicare Summary Notice (MSN) or Explanation of Benefits (EOB) from your private insurance plan to ensure accuracy. If you find errors, you have a right to question them.

Essential Steps Before You Negotiate

Preparation is key when you want to negotiate medical bills effectively. Gathering information and understanding your position strengthens your case and increases your chances of success in reducing healthcare costs.

Know Your Insurance Coverage

Review your health insurance policy thoroughly. Understand your deductible, out-of-pocket maximum, copayments, and coinsurance. Know which services require prior authorization and if your care was in-network or out-of-network. This information helps you determine what your insurer should have covered and what your legitimate financial responsibility is. If you have Medicare, understand your Part A, Part B, Part C (Medicare Advantage), and Part D coverage. Supplemental plans like Medigap can also significantly impact your out-of-pocket costs.

Gather All Relevant Documentation

Compile all paperwork related to your medical service:

- Your insurance card and policy details.

- All EOBs from your insurance company.

- Itemized bills from the provider.

- Any communication, notes, or records from your doctor or the hospital.

- Records of payments you have already made.

- Written estimates or quotes you received before the service.

Organizing these documents systematically helps you reference specific details during your medical bill negotiation.

Research Fair Pricing

Before you even pick up the phone, research what other providers charge for similar services in your area. Websites like Healthcare Bluebook, Fair Health Consumer, and the Medicare Procedure Price Lookup Tool can provide estimated costs for procedures and services. This data gives you leverage, allowing you to say, “I see that the average cost for this procedure in my zip code is $X, but your bill is $Y. Can you explain this difference?” This approach shows you have done your homework and are serious about how to negotiate hospital bills for seniors.

Understand State and Federal Protections

Familiarize yourself with laws that protect consumers, such as the No Surprises Act. This federal law, effective January 1, 2022, protects you from surprise medical bills for emergency services or certain non-emergency services at in-network facilities. It prevents providers from balance billing you for out-of-network services in specific situations. Understanding these protections helps you identify when a bill might be illegal or negotiable. The Centers for Medicare & Medicaid Services (CMS) provides detailed guidance on your rights under this act.

Effective Strategies for Medical Bill Negotiation

Once you have prepared, you are ready to engage in medical bill negotiation. Approach the conversation calmly, professionally, and persistently. Remember, providers prefer to collect some payment rather than none.

Identify the Right Person to Contact

Do not just call the main billing number. Ask to speak directly with the billing department supervisor, a patient advocate, or a financial counselor. These individuals often have the authority to make adjustments or set up payment plans. When you ask, “Who handles financial assistance or bill reductions for patients?”, you are likely to be directed to someone with decision-making power.

Start with a Calm, Assertive Approach

Clearly state your purpose: “I received a bill for [amount] for [service], and I believe there are discrepancies or I am unable to pay the full amount.” Present your findings from the itemized bill review. Point out any errors, duplicate charges, or services not rendered. For example, “My itemized bill shows a charge for two doses of medication X on October 15th, but I only received one.”

Always Ask for a Discount

Many hospitals and providers offer discounts, especially if you can pay a portion of the bill upfront in cash. Do not hesitate to ask:

- “Do you offer a prompt-pay discount for patients who pay within 30 days?”

- “Is there a discount for uninsured or underinsured patients?”

- “Can you reduce the total amount if I pay X dollars today?”

A common starting point for negotiation is to ask for a 20% to 30% reduction. Some facilities may offer even more, especially for larger bills. Always remember that the listed price is often not the final price.

Propose a Payment Plan

If a lump-sum discount is not an option, or if the remaining balance is still too high, propose an affordable payment plan. Be realistic about what you can pay each month based on your fixed income. For example, “I can consistently pay $100 per month. Can we set up a payment plan for that amount without interest?” Many providers are willing to work with you to avoid sending the bill to collections, which costs them money and effort. Ensure any payment plan includes zero interest and a clear agreement on the total amount you will pay.

Highlight Your Financial Hardship

If you are a senior on a fixed income, openly communicate your financial situation. Explain that high medical bills place a significant burden on your retirement budget. Many hospitals have charity care policies or financial assistance programs designed to help patients who meet specific income guidelines. Be prepared to provide documentation of your income, expenses, and assets if requested.

Get Agreements in Writing

Any agreement you reach, whether a discount or a payment plan, must be in writing. Request a revised bill or a written confirmation letter detailing the new total amount and payment terms. This protects you from future billing disputes or unexpected charges. Confirm the name and title of the person you spoke with, the date, and the agreed-upon terms.

Leveraging Financial Assistance Programs

Beyond direct negotiation, numerous programs exist to help seniors reduce healthcare costs and medical bill burdens.

Hospital Charity Care and Financial Assistance Programs

Most non-profit hospitals have legal obligations to provide charity care or financial assistance to patients who cannot afford their bills. Eligibility often depends on your income relative to the federal poverty level. For example, if your income falls below 200% of the federal poverty level, you may qualify for significant discounts or even full forgiveness of your bill. You will need to apply, providing documentation like tax returns, pay stubs, bank statements, and proof of household size. Ask the hospital’s financial counseling department for their specific charity care policy and application forms.

Medicaid and State Assistance Programs

Medicaid is a joint federal and state program that provides healthcare coverage for low-income individuals. If your income and assets are low, you might qualify for Medicaid, which could cover many of your medical expenses. Even if you have Medicare, you may qualify for a Medicare Savings Program (MSP), which helps pay for Medicare premiums, deductibles, and copayments. Each state has its own eligibility requirements. For information on eligibility and how to apply, visit Benefits.gov or your state’s Medicaid office.

Patient Advocacy Services

If you feel overwhelmed or find the process too challenging, consider using a professional patient advocate. These experts specialize in medical bill negotiation, finding errors, and navigating insurance complexities. They often work on a contingency basis, meaning they take a percentage of the savings they achieve for you. Organizations like the National Patient Advocate Foundation can provide resources or referrals. You can also explore local Area Agencies on Aging or the Eldercare Locator for assistance.

Pharmaceutical Assistance Programs

High prescription drug costs contribute significantly to overall medical bills. Many pharmaceutical companies offer patient assistance programs to help low-income individuals afford their medications. Websites like NeedyMeds.org or RxAssist.org provide databases of these programs. Additionally, look into discount prescription cards or ask your doctor about generic alternatives to reduce drug costs.

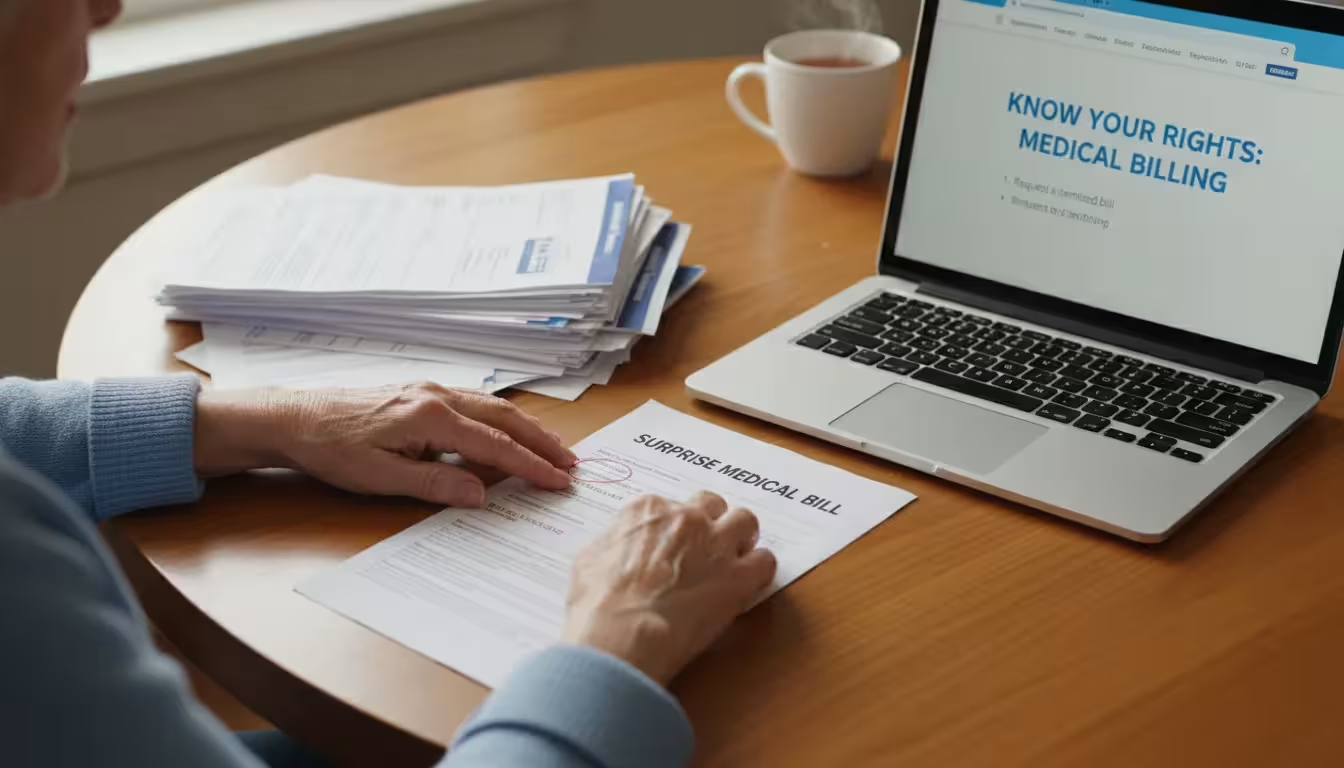

Navigating Balance Billing and Surprise Bills

Balance billing and surprise bills can dramatically inflate your medical expenses. Knowing your rights is essential for how to negotiate hospital bills for seniors in these situations.

Understanding Balance Billing

Balance billing occurs when a healthcare provider bills you for the difference between what your insurer paid and the total amount the provider charged. For example, if a doctor charges $500 for a service, and your insurance pays $300, the doctor might try to bill you for the remaining $200. This is illegal in many situations, especially for in-network providers or services covered by the No Surprises Act.

The No Surprises Act

This federal law protects you from surprise bills for emergency services, even if you receive care from an out-of-network provider or facility. It also applies to non-emergency services when you receive care from an out-of-network provider at an in-network hospital or ambulatory surgical center. Under this act, you are only responsible for your in-network cost-sharing amount. The provider cannot balance bill you for the difference. If you receive a bill that seems to violate this act, dispute it immediately. The Consumer Financial Protection Bureau (CFPB) offers resources on understanding and disputing medical bills, including those affected by the No Surprises Act.

When to Dispute a Bill

You should dispute a bill if:

- It contains errors or duplicate charges you identified in your itemized bill review.

- You suspect balance billing for services covered under the No Surprises Act.

- The services were not medically necessary, and you can get a statement from your doctor supporting this.

- You believe the charges are exorbitant compared to fair market prices.

- You did not receive prior authorization for a service that required it, and you were not informed of the potential cost.

Write a formal letter of dispute to the provider’s billing department and your insurance company. Include copies of all relevant documents and clearly state why you are disputing the bill. Keep a copy of everything you send.

Preventative Measures to Control Future Healthcare Costs

While negotiating existing bills helps, proactive steps to reduce healthcare costs in the future are equally important for long-term financial stability in retirement.

Regularly Review Your Insurance Plan

Your health needs and financial situation can change. Annually during open enrollment periods, review your Medicare Advantage plan, Medigap policy, or private health insurance. Compare premiums, deductibles, out-of-pocket maximums, and prescription drug coverage (Part D plans). Switching to a plan that better suits your current needs can save you hundreds, even thousands, of dollars each year. For example, if your preferred doctors or hospitals change, ensure your plan still includes them in its network.

Prioritize Preventative Care

Preventative care, such as annual check-ups, flu shots, mammograms, and colonoscopies, is often covered at 100% by Medicare and most private insurance plans. Investing in preventative health helps catch potential health issues early, often before they become serious and require expensive treatments. For example, managing high blood pressure through regular check-ups and medication is far less costly than treating a stroke or heart attack.

Utilize Generic and Mail-Order Prescriptions

Always ask your doctor if a generic alternative is available for your prescription medications. Generic drugs contain the same active ingredients and work in the same way as their brand-name counterparts but cost significantly less. Additionally, consider using mail-order pharmacies for maintenance medications. Many insurance plans offer lower copayments for 90-day supplies ordered through mail. Always check GoodRx or similar services for coupons, as sometimes these discounts can beat your insurance copay. The AARP frequently publishes tips for reducing prescription drug costs.

Understand Telehealth Options

Telehealth has become a convenient and often more affordable way to access certain medical services. For routine consultations, follow-ups, or minor ailments, a virtual visit can save you time, transportation costs, and potentially a higher copay associated with an in-person specialist visit. Check with your insurance provider and doctor about telehealth coverage and availability.

Frequently Asked Questions

Can a hospital refuse treatment if I cannot pay my bill?

Hospitals are legally obligated to provide emergency medical treatment regardless of your ability to pay, under the Emergency Medical Treatment and Labor Act (EMTALA). For non-emergency care, a hospital can refuse treatment if you cannot pay. However, most non-profit hospitals have financial assistance programs or charity care policies that you can apply for to avoid being denied necessary care due to inability to pay.

What if my medical bill goes to collections?

If your medical bill goes to collections, it can negatively impact your credit score. Do not ignore collection notices. Contact the collection agency and explain that you are disputing the bill or trying to negotiate directly with the provider. You have the right to request validation of the debt, meaning the collector must provide proof that you owe the money. It is often still possible to negotiate medical bills, even after they have been sent to collections. Aim to settle for a lower amount or establish a payment plan.

Should I use a credit card to pay medical bills?

Using a credit card for medical bills should be a last resort. Credit cards often carry high interest rates, which can quickly make your debt unmanageable. If you cannot negotiate a discount or a zero-interest payment plan directly with the provider, and you absolutely must pay, consider low-interest personal loans or lines of credit if available and affordable. Always exhaust negotiation, financial assistance, and charity care options first to reduce healthcare costs before incurring high-interest debt.

How long do I have to negotiate a medical bill?

There is no strict legal deadline to negotiate medical bills. However, it is always best to act promptly, ideally within 30-90 days of receiving the bill. The longer you wait, the more likely the bill is to be sent to collections, complicating the negotiation process. Many providers offer prompt-pay discounts for quick resolution. You can still negotiate even after a bill goes to collections, but early action is more effective.

Can Medicare or my supplemental insurance help with medical bill negotiation?

Medicare itself does not directly negotiate bills on your behalf, but it sets allowable charges that providers must accept for Medicare-covered services. Your Medicare Summary Notice (MSN) helps you identify discrepancies. If you have a Medigap (Medicare Supplement) plan, it will pay your share of Medicare-approved costs, like deductibles and coinsurance, after Medicare pays its portion, significantly reducing your out-of-pocket expenses and often eliminating the need for further negotiation on approved amounts. Medicare Advantage plans handle billing differently, and you should review your plan’s specific EOBs and contact their customer service for any discrepancies.

For official financial guidance for seniors, visit

Consumer Financial Protection Bureau (CFPB),

IRS.gov and

Benefits.gov.

Disclaimer: This article is for informational purposes and is not a substitute for professional financial or tax advice. Consult with a certified financial planner or tax professional for guidance on your specific situation.