Introduction: Taking Control of Your Finances in Retirement

Retirement should be a time of security and enjoyment, a well-deserved reward for a lifetime of hard work. But for many, the transition to a fixed income can bring new financial challenges and anxieties. Navigating Social Security, Medicare, investments, and taxes without a regular paycheck requires a shift in mindset and careful management. The good news is that with the right knowledge, you can steer clear of common pitfalls and protect your financial well-being.

This guide is designed to empower you. We will walk through the most significant financial mistakes seniors make and provide clear, actionable steps on how to avoid them. Think of this as your roadmap to a more secure and confident financial future. Good financial planning isn’t about complex charts or risky bets; it’s about making smart, informed decisions that align with your goals. By understanding the landscape of retirement finance, you can safeguard your assets, make your money last, and focus on what truly matters: living your best life.

Understanding Key Retirement Finance Concepts

Before we dive into the specific mistakes, let’s clarify a few fundamental concepts you will encounter throughout your retirement. Getting these basics right is the first step toward solid financial footing.

Social Security Claiming Ages

Social Security is a cornerstone of retirement income for most Americans. However, the amount you receive depends heavily on when you decide to start taking benefits. You can begin as early as age 62, but your monthly payment will be permanently reduced. If you wait until your “full retirement age” (FRA), which is typically 66 or 67 depending on your birth year, you receive your full, standard benefit. If you delay even longer, up to age 70, your benefit increases by about 8% for each year you wait past your FRA. The difference can be substantial.

Example: If your full retirement benefit at age 67 is $2,000 per month, claiming at 62 would reduce it to around $1,400. But if you wait until age 70, your benefit would grow to about $2,480 per month. That’s over $1,000 more each month for the rest of your life.

Required Minimum Distributions (RMDs)

The government allows you to save for retirement in tax-deferred accounts like a Traditional IRA or a 401(k). This means you don’t pay taxes on the money as it grows. However, they won’t let you keep it there forever. Starting at age 73 (for those who turn 72 after Dec. 31, 2022), you must begin taking out a certain amount each year. This is called a Required Minimum Distribution, or RMD. The amount is calculated based on your account balance and your life expectancy, according to tables provided by the IRS. This withdrawal is treated as taxable income.

For official information on Social Security and Medicare, visit SSA.gov and Medicare.gov. Federal tax information is at the IRS.

Healthcare Costs and Medicare

While Medicare is an essential benefit, it does not cover all healthcare expenses. Medicare Part A (hospital insurance) is usually premium-free, but Part B (medical insurance) has a monthly premium. There are also deductibles, copayments, and costs for prescription drugs (Part D). Most importantly, Medicare generally does not cover long-term care, such as extended stays in a nursing home or an assisted living facility. Understanding these potential out-of-pocket costs is critical for your budget.

The 7 Biggest Financial Mistakes Seniors Make (and How to Fix Them)

Now that we’ve covered the basics, let’s explore the most common and costly senior mistakes in managing money. By recognizing these traps, you can take proactive steps to avoid them.

Mistake 1: Claiming Social Security at the Wrong Time

As we saw, claiming Social Security early at age 62 locks in a lower monthly payment for life. While it can be tempting to get that money sooner, it’s often not the optimal financial move, especially if you are in good health and expect to live a long life. Many people underestimate their longevity and regret not waiting for a larger check that provides more security later in life, especially after a spouse passes away.

How to Avoid It: Don’t make a snap decision. Analyze your entire financial picture. Consider your health, your family’s history of longevity, whether you plan to continue working, and if you have other sources of income (like a pension or retirement savings) to live on while you delay benefits. A higher, inflation-protected Social Security benefit can be one of the best forms of longevity insurance there is.

Mistake 2: Ignoring or Miscalculating RMDs

Forgetting to take your RMD from your retirement accounts is a surprisingly common and expensive error. The penalty is severe: the IRS can charge a 25% tax on the amount you were supposed to withdraw but didn’t. This can be reduced to 10% if you correct the mistake in a timely manner, but it’s still a significant and completely avoidable loss.

Example: If your RMD for the year is $8,000 and you forget to take it, the IRS could impose a penalty of $2,000 (25% of $8,000). That’s money you’ve simply given away for nothing.

How to Avoid It: Be proactive. Ask your financial institution or custodian to calculate your RMD for you each year. Many will even let you set up automatic withdrawals to be sent to your bank account. Mark the December 31 deadline on your calendar and set a reminder for yourself in early fall to ensure you have plenty of time to act.

Mistake 3: Underestimating Healthcare and Long-Term Care Costs

Many seniors are unprepared for just how much of their budget will be consumed by healthcare. A healthy 65-year-old couple retiring today can expect to spend hundreds of thousands of dollars on healthcare throughout their retirement—and that figure doesn’t even include long-term care. Assuming Medicare will cover everything is a major financial planning oversight.

How to Avoid It: Budget realistically for healthcare. When you enroll in Medicare, carefully review your options between traditional Medicare with a Medigap supplement and a Medicare Advantage plan to see what best fits your needs and budget. More importantly, have a plan for long-term care. This could involve purchasing long-term care insurance, setting aside specific funds in a savings or investment account, or discussing options with your family.

Mistake 4: Having an Inappropriate Investment Mix

Retirement investing is about balance. Two common mistakes lie at opposite ends of the spectrum.

- Being Too Conservative: Fearing market volatility, some seniors pull all their money out of stocks and put it into cash, CDs, or other “safe” investments. The problem is inflation. If your money earns 1% interest but inflation is 3%, your savings are losing 2% of their purchasing power every year.

- Being Too Aggressive: On the other hand, continuing to take big risks with a portfolio heavy in stocks can be disastrous. A major market downturn right after you retire can deplete your nest egg without giving you the time to recover your losses.

How to Avoid It: Work toward a balanced portfolio that includes a mix of stocks for growth (to beat inflation) and bonds or other fixed-income assets for stability and income. A common rule of thumb is the “Rule of 100,” where you subtract your age from 100 to determine the percentage of stocks you should hold. For example, a 70-year-old might aim for 30% in stocks and 70% in bonds. This is just a guideline; your personal risk tolerance is what truly matters.

Mistake 5: Neglecting Essential Estate Planning

No one likes to think about it, but failing to plan for what happens after you’re gone can create enormous financial and emotional stress for your loved ones. If you pass away without a will, state law will decide how your assets are distributed, and it may not be what you would have wanted. Furthermore, without a designated power of attorney for finances and healthcare, your family may face a difficult court process to manage your affairs if you become incapacitated.

How to Avoid It: Put your wishes in writing. At a minimum, every adult should have a will, a durable power of attorney, and a healthcare proxy (or living will). These documents ensure your assets are distributed according to your wishes and that someone you trust can make decisions for you if you cannot. Review these documents every 5-10 years or after any major life event, like a marriage, death, or birth in the family.

Mistake 6: Not Creating a Realistic Retirement Budget

Your expenses change in retirement. You might spend less on commuting and work clothes, but you may spend more on travel, hobbies, and healthcare. Many people enter retirement assuming their spending will drop dramatically, only to find that it stays the same or even increases in the early, more active years. Living without a budget on a fixed income is like driving without a map—you will eventually get lost.

How to Avoid It: Before you retire, and certainly once you have, track your spending for three to six months to see where your money is actually going. Use this information to create a detailed, realistic budget. List all your income sources (Social Security, pensions, investment withdrawals) and all your expenses. This clarity will allow you to make adjustments and ensure your spending aligns with your income, preventing you from drawing down your savings too quickly.

Mistake 7: Co-signing Loans for Children or Grandchildren

It is natural to want to help your family. But co-signing a loan for a car, a mortgage, or a student loan is one of the riskiest financial moves a senior on a fixed income can make. When you co-sign, you are not just a character reference—you are 100% legally responsible for the entire debt if the primary borrower stops paying. Lenders often ask for a co-signer precisely because they don’t believe the primary borrower can handle the loan alone. A sudden demand to repay a large loan could completely derail your retirement.

How to Avoid It: Say no, and explain why your fixed income makes it impossible to take on that risk. There are other ways to help that don’t jeopardize your financial security. You could offer a small, fixed amount of cash as a gift, help them create a budget to save for a down payment, or provide non-financial support like babysitting so they can work more hours.

Financial Red Flags and Scams to Watch Out For

Unfortunately, scammers often target seniors, believing they have accumulated savings and may be less tech-savvy. Being aware of their tactics is your best defense.

The Grandparent Scam

You receive a frantic phone call from someone pretending to be your grandchild. They say they are in trouble—a car accident, arrested in another country, or in the hospital—and need you to wire money immediately. They beg you not to tell their parents. The urgency and emotional manipulation are designed to make you act before you can think.

Warning Signs: A sense of extreme urgency, a request for secrecy, and a demand for payment via wire transfer, gift cards, or a cryptocurrency app. These payment methods are like sending cash; once the money is gone, it’s virtually impossible to get back.

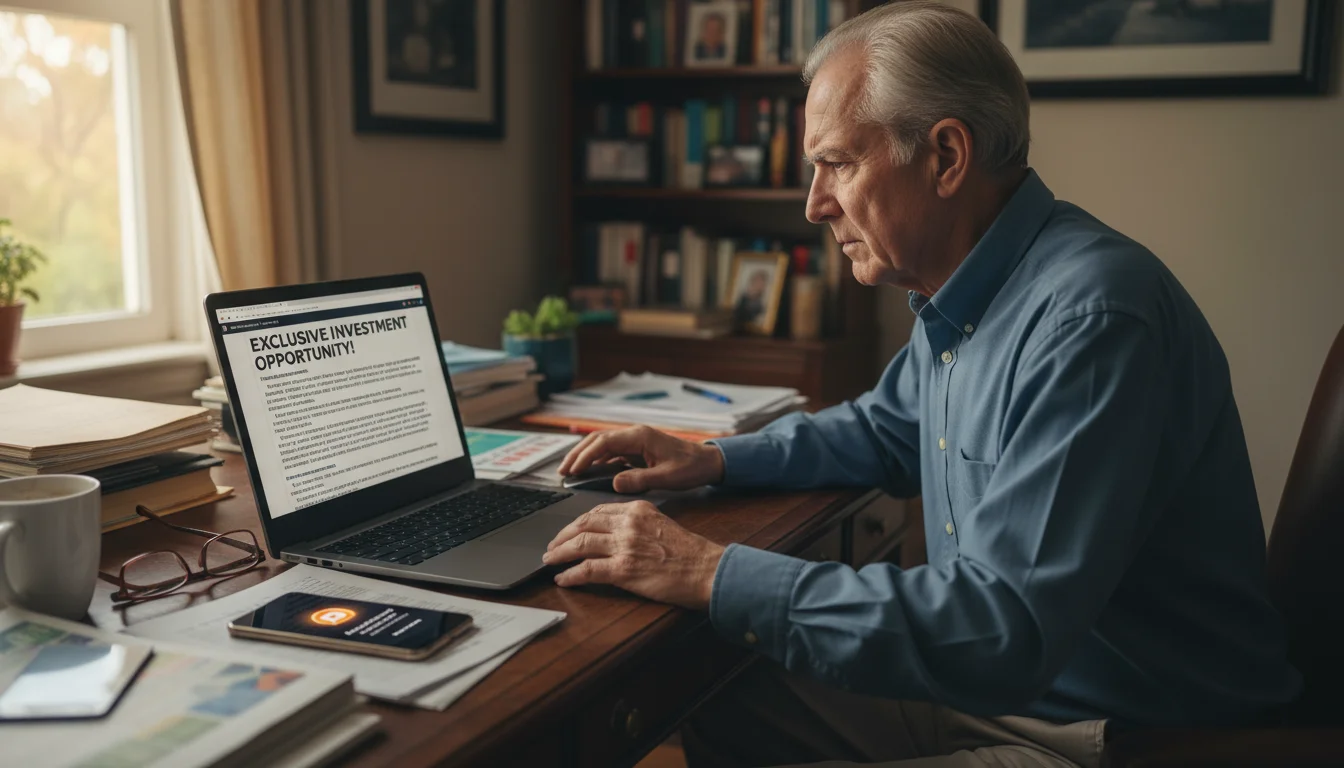

Phony Investment Schemes

These scams often come through email, a social media message, or a cold call. The scammer promises an investment with “guaranteed” high returns and “no risk.” They may use high-pressure tactics, telling you it’s a limited-time opportunity you have to act on now. The investment is often vague or overly complex, designed to confuse you.

Warning Signs: Promises of guaranteed returns (all legitimate investments have some level of risk), pressure to “act now,” and requests to invest using non-traditional methods. Always be skeptical of unsolicited investment offers.

To protect yourself from scams and for consumer information, consult the Consumer Financial Protection Bureau (CFPB) and the FTC.

A Financial Checklist to Avoid Common Mistakes

Feeling overwhelmed? Don’t be. Here is a simple checklist to keep your retirement finance on track. Work through these steps one by one to build a strong financial foundation.

First, analyze your Social Security claiming options and decide on a strategy that maximizes your lifetime benefit based on your personal circumstances. Second, if you are over 73, calculate your RMD for the year and set a clear plan to withdraw it before the deadline. Third, thoroughly review your healthcare coverage, including Medicare and any supplemental plans, and start thinking about a long-term care strategy. Fourth, look at your investment portfolio to ensure it is balanced appropriately for your age and risk tolerance. Fifth, create or update your essential estate planning documents, including your will and powers of attorney. Finally, create and live by a detailed monthly budget that reflects your actual retirement income and expenses. Taking these concrete steps will help you avoid the most damaging financial mistakes seniors make.

Frequently Asked Questions

Is it ever a good idea to claim Social Security at 62?

Yes, in certain situations. If you have a serious health condition and do not expect a long lifespan, claiming early may result in more total benefits. It can also be necessary if you are no longer able to work and have no other source of income to bridge the gap until your full retirement age. The key is to make it a conscious choice based on your specific situation, not a default decision.

What happens if I have both a 401(k) and a Traditional IRA? Do I take RMDs from both?

Yes, you must calculate the RMD for each account separately. However, for IRAs (including Traditional, SEP, and SIMPLE IRAs), the IRS allows you to total the RMD amounts from all your IRA accounts and then take that full amount from just one of them, or any combination you choose. This rule does not apply to 401(k)s; the RMD for each 401(k) must be taken from that specific account.

I don’t have a large estate. Do I still need a will?

Absolutely. A will isn’t just for the wealthy. It’s the only way to ensure your assets, no matter how modest, go to the people or charities you choose. It also allows you to name an executor to handle your affairs, which can simplify the process for your family. Without a will, a court will make these decisions for you, which can cause delays and family disputes.

How can I protect my savings from being eroded by inflation?

The best long-term defense against inflation is a diversified investment portfolio that includes assets poised for growth, like stocks or stock mutual funds. While you want to reduce risk in retirement, eliminating all growth potential can be just as dangerous. Other tools include Treasury Inflation-Protected Securities (TIPS) and Series I Savings Bonds, which are government bonds designed to keep pace with inflation. For some, certain types of annuities can also provide inflation-protected income.

Disclaimer: This article is for informational purposes and is not a substitute for professional financial or tax advice. Consult with a certified financial planner or tax professional for guidance on your specific situation.

For expert guidance on senior health and finance, visit Social Security Administration (SSA), Consumer Financial Protection Bureau (CFPB) and Administration for Community Living (ACL).

|

Fact-Checked Content

Our editorial team reviews all content for accuracy and updates it regularly. Learn about our editorial process →

|