Financial Red Flags and Scams to Watch Out For

Seniors are often targeted by financial scams that can devastate a carefully planned retirement budget. Being aware of the tactics fraudsters use is your best defense. Here are three common schemes to watch for.

1. The Grandparent Scam

How it works: You receive a frantic phone call from someone pretending to be your grandchild. They claim to be in trouble—often arrested, in a car accident, or stuck in a foreign country—and desperately need you to wire money immediately. They will beg you not to tell their parents to maintain the element of secrecy and urgency.

Red flags: The scammer will pressure you to act instantly and will insist on payment via wire transfer, gift cards, or a money-transfer app. These methods are difficult to trace and nearly impossible to reverse. Always hang up and call your grandchild or another family member directly using a phone number you know is legitimate to verify the story.

2. High-Pressure Investment Seminars

How it works: You might be invited to a free lunch or dinner seminar that promises to reveal “secrets” to a wealthy retirement. The presentation is often slick and persuasive, but the goal is to pressure you into buying complex, high-fee financial products like certain types of annuities or private investments that are unsuitable for most retirees.

Red flags: Be wary of anyone promising “guaranteed” high returns with no risk. If an advisor pressures you to make a decision on the spot or discourages you from discussing the investment with a trusted family member or financial professional, walk away. Legitimate financial planning does not involve high-pressure sales tactics.

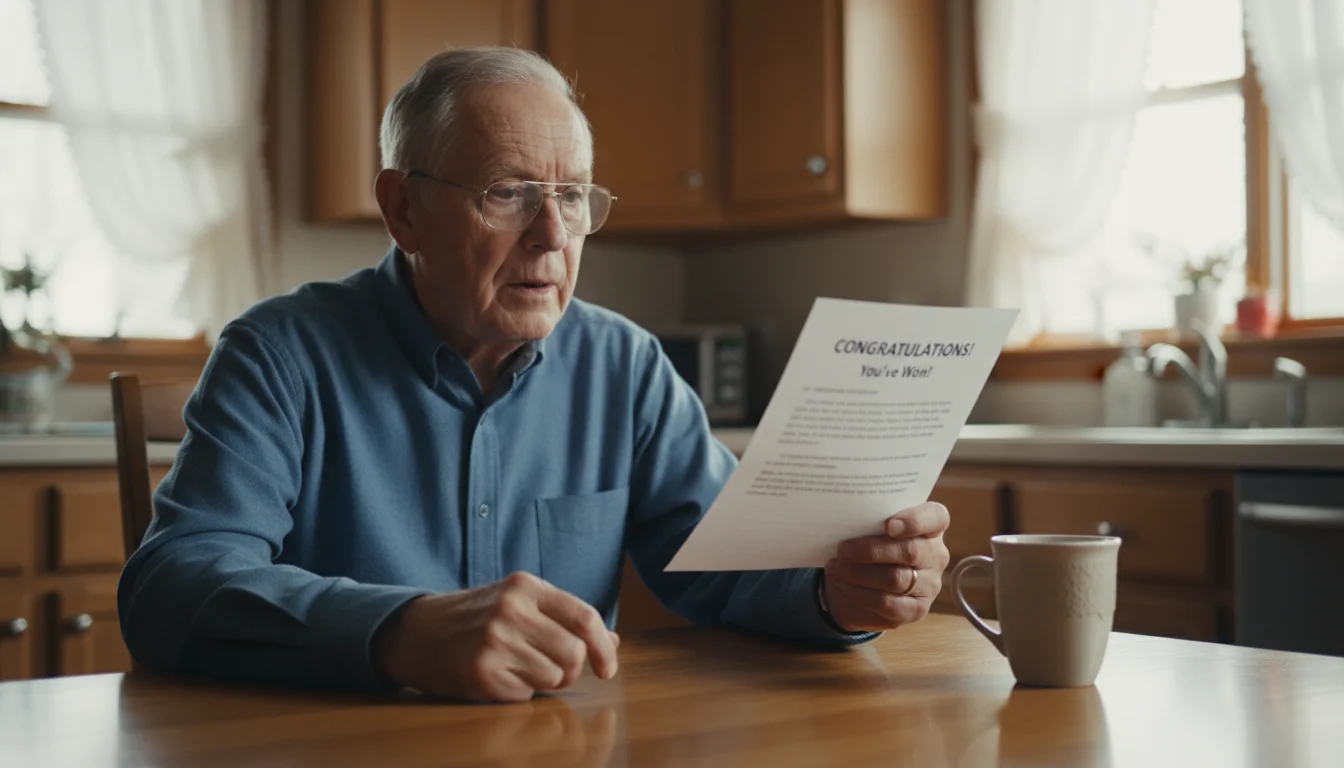

3. The “You’ve Won!” Sweepstakes or Lottery Scam

How it works: You receive a call, letter, or email informing you that you have won a large sum of money or a luxury prize. The catch? To claim your winnings, you first have to pay a fee to cover “taxes,” “shipping,” or “processing.”

Red flags: You should never have to pay money to receive a legitimate prize. The scammers will take your “fee” and you will never hear from them again. The IRS collects taxes on winnings directly; a lottery company will never ask you to pay them first. To protect yourself from scams and for consumer information, consult the Consumer Financial Protection Bureau (CFPB) and the FTC. They offer excellent resources and reporting tools.