Introduction: Taking Control of Your Finances in Retirement

Retirement is a new chapter, one that you have worked hard to reach. It should be a time of peace, not financial anxiety. For many seniors living on a fixed income, managing money can feel like a daunting task. The regular paychecks may have stopped, but the bills have not. This is where a budget becomes your most powerful tool. It is not about restriction; it is about empowerment. A clear, well-organized budget gives you a complete picture of your financial health, helping you make informed decisions, stretch your dollars further, and protect the assets you have spent a lifetime building.

Thinking about creating a budget from scratch might seem overwhelming, but it is far simpler than you might imagine. A retirement budget spreadsheet is a straightforward way to track your income and expenses, giving you a clear view of where every dollar is going. This guide will walk you through, step by step, how to create a simple yet effective spreadsheet. We will demystify the process, provide actionable tips, and give you the confidence to take firm control of your financial future. This is a crucial step in ensuring your retirement years are as secure and comfortable as you deserve.

Understanding the Financial Basics of a Retirement Budget

Before you open a spreadsheet, it is important to understand the core components of a retirement budget. Unlike the budget you may have used during your working years, a retirement budget has a different focus. Instead of building wealth, the primary goal is now preserving it and ensuring your income streams can sustain your lifestyle for the long term. Let’s break down the key elements.

Income: Your Financial Inflows

In retirement, your income is typically fixed, meaning it does not change much from month to month. Identifying all your income sources is the first step in building your budget. These may include:

Social Security: For most retirees, this is a foundational piece of their income. It is a predictable, monthly payment.

Pensions: If you or your spouse worked for a company or government agency with a defined-benefit plan, you likely receive a monthly pension.

Retirement Account Withdrawals: This includes money you take from a 401(k), 403(b), or a Traditional IRA. If you are over 73, you may be required to take Required Minimum Distributions (RMDs), which become a mandatory part of your income.

Annuity Payments: If you purchased an annuity, you will receive regular payments from it.

Investment Income: This could be dividends from stocks or interest from bonds or savings accounts.

Part-Time Work: Some retirees choose to work part-time for extra income or to stay engaged.

Let’s use a simple example. Imagine your monthly income is: $1,800 from Social Security, $700 from a pension, and $500 from an IRA withdrawal. Your total monthly income to budget with would be $1,800 + $700 + $500 = $3,000.

Expenses: Your Financial Outflows

Your expenses are where your money goes. The key to successful budgeting for seniors is to accurately track these outflows. We can divide them into two main categories: fixed and variable.

Fixed Expenses: These are costs that generally stay the same each month. They are predictable and form the backbone of your budget. Examples include:

- Mortgage or Rent Payment

- Property Taxes (if not included in mortgage)

- Homeowners or Renters Insurance

- Car Payment and Car Insurance

- Health Insurance Premiums (like Medicare Part B and supplemental plans)

- Life Insurance Premiums

- Cable, Internet, and Phone Bills

Variable Expenses: These costs can change from month to month and are where you have the most control to make adjustments. Examples include:

- Groceries and Dining Out

- Utilities (electricity, gas, water can fluctuate)

- Transportation (gas, vehicle maintenance, public transit)

- Healthcare Costs (co-pays, prescriptions, over-the-counter items)

- Personal Care (haircuts, toiletries)

- Entertainment, Hobbies, and Travel

- Gifts and Charitable Donations

Understanding the difference between these is vital. While you cannot easily change your rent payment, you can adjust how much you spend on dining out. This is where your budget gives you power.

Actionable Strategies and Money-Saving Tips

Now, let’s build your retirement budget spreadsheet. You do not need to be a technology expert. If you have a computer, you can use free programs like Google Sheets or pre-installed software like Microsoft Excel. If you prefer, you can even draw the same columns in a notebook. The tool is less important than the process.

Step 1: Choose Your Tool and Set Up Your Columns

Open a new spreadsheet. At the top, you will want to create several columns. A simple, effective layout includes:

- Column A: Category (e.g., Social Security, Rent, Groceries)

- Column B: Budgeted Amount (What you plan to receive or spend)

- Column C: Actual Amount (What you actually receive or spend)

- Column D: Difference (The difference between Budgeted and Actual)

This structure allows you to not only plan but also track your progress and see where you might be over or under spending.

Step 2: List Your Monthly Income

In the first section of your spreadsheet, list every source of income. Use the columns you just created. It might look something like this:

INCOME

- Category: Social Security

- Budgeted: $1,800

- Actual: $1,800

- Difference: $0

- Category: Pension

- Budgeted: $700

- Actual: $700

- Difference: $0

- Category: IRA Withdrawal

- Budgeted: $500

- Actual: $500

- Difference: $0

At the bottom of this section, create a “Total Income” row. Here, you will add up the “Budgeted” and “Actual” columns. In our example, your Total Budgeted Income is $3,000.

Step 3: List Your Monthly Expenses

This is the most time-consuming part, but it is also the most insightful. Gather your bank statements, credit card bills, and receipts from the past two to three months to get an accurate picture of your spending habits. Create two sub-sections: Fixed Expenses and Variable Expenses.

FIXED EXPENSES

List all your predictable costs. For example:

- Category: Rent/Mortgage

- Budgeted: $1,200

- Category: Medicare Part B Premium

- Budgeted: $174.70

- Category: Car Insurance

- Budgeted: $80

- Category: Phone/Internet

- Budgeted: $100

VARIABLE EXPENSES

Now, list the expenses that change. Be honest with yourself. Look at your past statements to create a realistic budget amount.

- Category: Groceries

- Budgeted: $450

- Category: Transportation (Gas)

- Budgeted: $120

- Category: Prescriptions & Co-pays

- Budgeted: $150

- Category: Entertainment

- Budgeted: $100

Continue this for all your expense categories. At the end of the month, you will fill in the “Actual” column for each item. Create a “Total Expenses” row at the bottom and add up the “Budgeted” and “Actual” columns.

Step 4: Calculate Your Net Cash Flow

This is the moment of truth. Create a final section at the bottom of your spreadsheet called “Net Cash Flow” or “Surplus/Deficit.” The calculation is simple:

Total Income – Total Expenses = Net Cash Flow

Let’s continue our example. Your Total Budgeted Income is $3,000. Let’s say your Total Budgeted Expenses add up to $2,875.

$3,000 (Income) – $2,875 (Expenses) = +$125 (Surplus)

This is a great result! It means your plan has you spending less than you earn.

However, what if your expenses were $3,100?

$3,000 (Income) – $3,100 (Expenses) = -$100 (Deficit)

This tells you that your current spending habits are not sustainable, and you need to make adjustments.

Step 5: Analyze and Adjust

Your budget spreadsheet is a living document. At the end of each month, fill in the “Actual” column for every line item and calculate the “Difference.”

If you have a surplus: Congratulations! This is an opportunity. You can assign this extra money a job. You could put it into an emergency savings account, use it for a planned future expense like a vacation, or invest it. Giving every dollar a purpose is a key principle of smart money management.

If you have a deficit: Do not panic. This is why you created the budget—to identify problems before they become crises. Look at your “Variable Expenses” section. Where did you overspend? Was it a one-time unexpected expense, like a car repair, or a pattern of overspending in an area like dining out? Identify areas where you can cut back. Could you cook at home more often, find a cheaper cable plan, or look for free community entertainment options? Making small, consistent changes can quickly turn a deficit into a surplus.

Using money tools like this spreadsheet gives you the data you need to make smart, strategic decisions instead of guessing.

Financial Red Flags and Scams to Watch Out For

As a senior managing your finances, you are unfortunately a prime target for scammers. Being aware of their tactics is your best defense. Here are a few red flags related to budgeting and financial management.

1. Phishing Scams with Fake Budgeting Tools

Scammers know that people are looking for helpful finance templates and budgeting apps. They will send official-looking emails or create pop-up ads for “free” money tools that promise to simplify your life. When you click the link and download the software or sign up, you are unknowingly giving them access to your device or handing over your personal information.

Warning Signs: Unsolicited emails with urgent calls to action (“Download our tool now to save thousands!”). Poor grammar or spelling in the advertisement. A website address that is slightly different from a well-known company.

How to Protect Yourself: Never click on links in unsolicited emails. Only download software from trusted sources like the official Apple App Store or Google Play Store. For official financial information, always go directly to the source.

For official information on Social Security and Medicare, visit SSA.gov and Medicare.gov. Federal tax information is at the IRS.

2. The “Bank Investigator” Scam

In this scam, a criminal calls you pretending to be from your bank’s fraud department. They might say something like, “We’ve noticed some unusual spending on your account that does not match your typical budget. We need you to verify your information to secure your account.” They will then ask for your account number, password, or Social Security number. They use your desire to be a responsible budgeter against you.

Warning Signs: A sense of extreme urgency. Threats that your account will be frozen if you do not act immediately. Any request for your full password or PIN.

How to Protect Yourself: Hang up. Your bank will never call you and ask for this information. If you are concerned, find your bank’s official phone number on their website or the back of your debit card and call them directly to inquire.

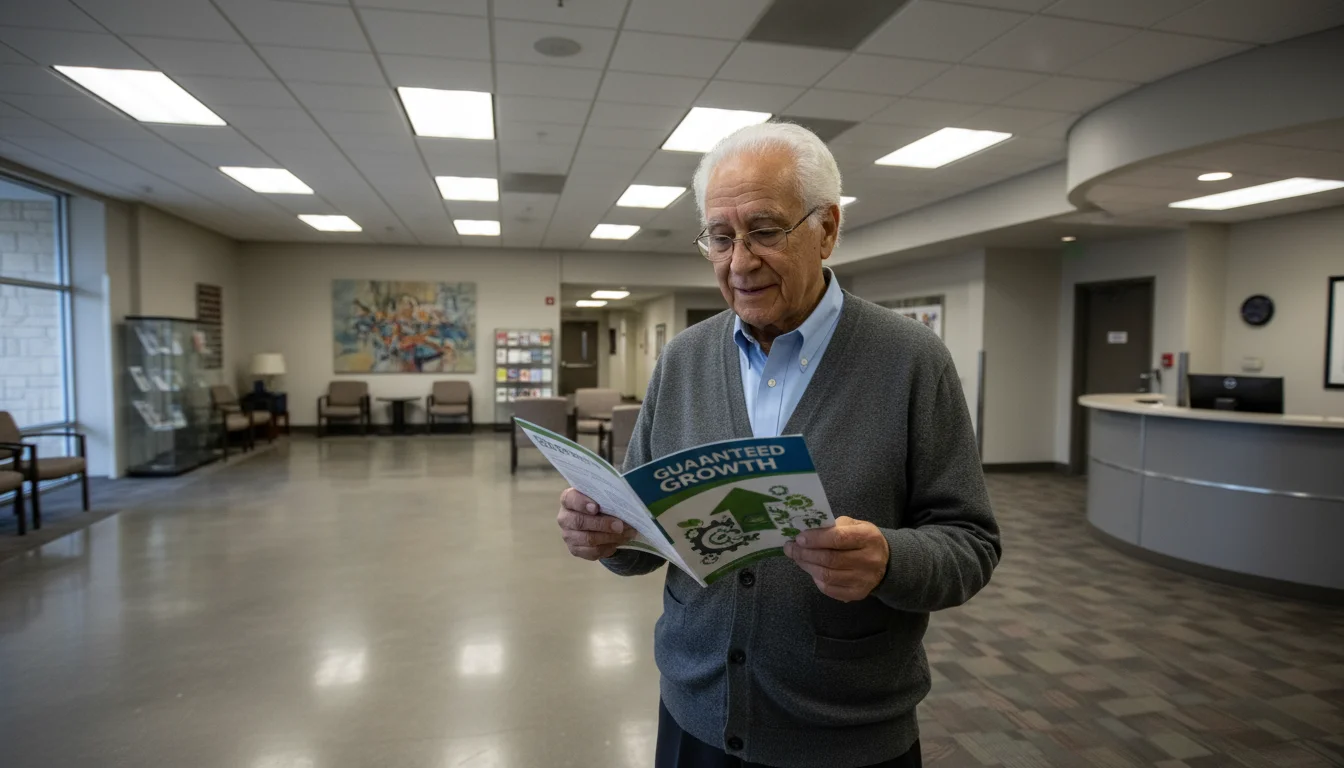

3. “Guaranteed” High-Return Investment Scams

If your budget shows a surplus, you might be looking for ways to grow that extra money. Scammers prey on this by offering investment opportunities that promise incredibly high returns with “no risk.” They might contact you online or through a “free” investment seminar.

Warning Signs: The promise of “guaranteed” returns. Pressure to invest immediately (“This opportunity is only available today!”). Vague details about how the investment actually works.

How to Protect Yourself: Remember the old saying: if it sounds too good to be true, it probably is. Legitimate investing always involves risk. Never be pressured into making a quick financial decision.

To protect yourself from scams and for consumer information, consult the Consumer Financial Protection Bureau (CFPB) and the FTC.

A Financial Checklist for Creating Your Budget

Feeling ready to start? Here is a simple checklist to guide you through the process of creating and maintaining your retirement budget spreadsheet.

First, choose your preferred tool. Decide whether you want to use a digital spreadsheet like Google Sheets or a physical notebook. The best tool is the one you will consistently use.

Second, gather all your financial documents. Collect at least two months’ worth of bank statements, credit card bills, utility bills, and any statements from your income sources like Social Security or a pension.

Third, build the framework of your spreadsheet. Create your sections for Income, Fixed Expenses, and Variable Expenses. Set up your columns for “Category,” “Budgeted,” “Actual,” and “Difference.”

Fourth, fill in your budgeted amounts. Go through your documents and list all your income sources and expenses, assigning a realistic planned amount to each one.

Fifth, track your actual spending throughout the month. Keep receipts or check your online banking regularly to see how your actual spending compares to your budget.

Sixth, review and analyze at the end of the month. Calculate your net cash flow. Identify where you were successful and where you overspent. This is your chance to learn and improve.

Finally, make adjustments for the next month. Use the information you learned to create a more accurate and effective budget for the upcoming month. Remember, budgeting is a continuous cycle of planning, tracking, and adjusting.

Frequently Asked Questions

What if my income varies from month to month, like from a small side business?

This is a common situation for many retirees. The safest approach is to budget based on your lowest anticipated monthly income. For example, if your side business brought in $400 one month, $250 the next, and $500 the month after, you might budget for only $250. Any income you earn above that amount becomes an automatic surplus, which you can then put directly into savings or toward a specific goal. This conservative approach helps prevent overspending.

How often should I review and update my budget?

You should engage with your budget on two different levels. On a weekly or monthly basis, you should be tracking your actual spending and comparing it to your budgeted amounts. This keeps you on course. Then, on a quarterly or annual basis, you should do a “deep dive” review. Have any of your fixed costs changed, like an insurance premium increase? Does inflation mean you need to adjust your grocery budget? Has a life event changed your financial picture? Regular reviews keep your budget relevant and realistic.

Are there any good, free finance templates I can use to get started?

Absolutely. Both Google Sheets and Microsoft Excel offer a variety of free, pre-built budgeting templates. You can find them by opening the program and searching for “budget” or “monthly budget” in their template gallery. These are excellent starting points and can save you the time of setting up the spreadsheet from scratch. Just be sure you are getting them directly from these trusted software providers and not from a third-party website you do not recognize.

My biggest variable expense is healthcare. How can I possibly budget for unpredictable medical costs?

Budgeting for healthcare is a major concern in budgeting for seniors. A great strategy is to create a “sinking fund” specifically for medical costs. This is just a dedicated savings account. In your monthly budget, add a line item called “Medical Savings” and contribute a set amount to it each month, say $50 or $100. This money builds up over time. When an unexpected co-pay or prescription cost arises, you can pull from this fund instead of disrupting your entire budget. Also, be sure to review your Medicare coverage annually during open enrollment to ensure you have the most cost-effective plan for your needs.

What is the difference between a budget and a financial plan?

This is an excellent question. Think of it like this: a budget is your short-term road map, while a financial plan is your long-term destination. Your budget deals with the day-to-day and month-to-month management of your cash flow—income versus expenses. A financial plan addresses your big-picture goals, such as estate planning, long-term care strategy, investment allocation, and ensuring your money will last throughout your entire retirement. Your budget is a critical tool that helps you execute your financial plan successfully.

Disclaimer: This article is for informational purposes and is not a substitute for professional financial or tax advice. Consult with a certified financial planner or tax professional for guidance on your specific situation.

For expert guidance on senior health and finance, visit Medicare.gov, National Institute of Mental Health (NIMH), National Institutes of Health (NIH), Centers for Medicare & Medicaid Services (CMS) and Social Security Administration (SSA).

|

Fact-Checked Content

Our editorial team reviews all content for accuracy and updates it regularly. Learn about our editorial process →

|