Financial Red Flags and Scams to Watch Out For

Where there is a great need, there are often people looking to take advantage. The world of senior insurance and financial planning has its share of pitfalls. Here are a few to watch out for.

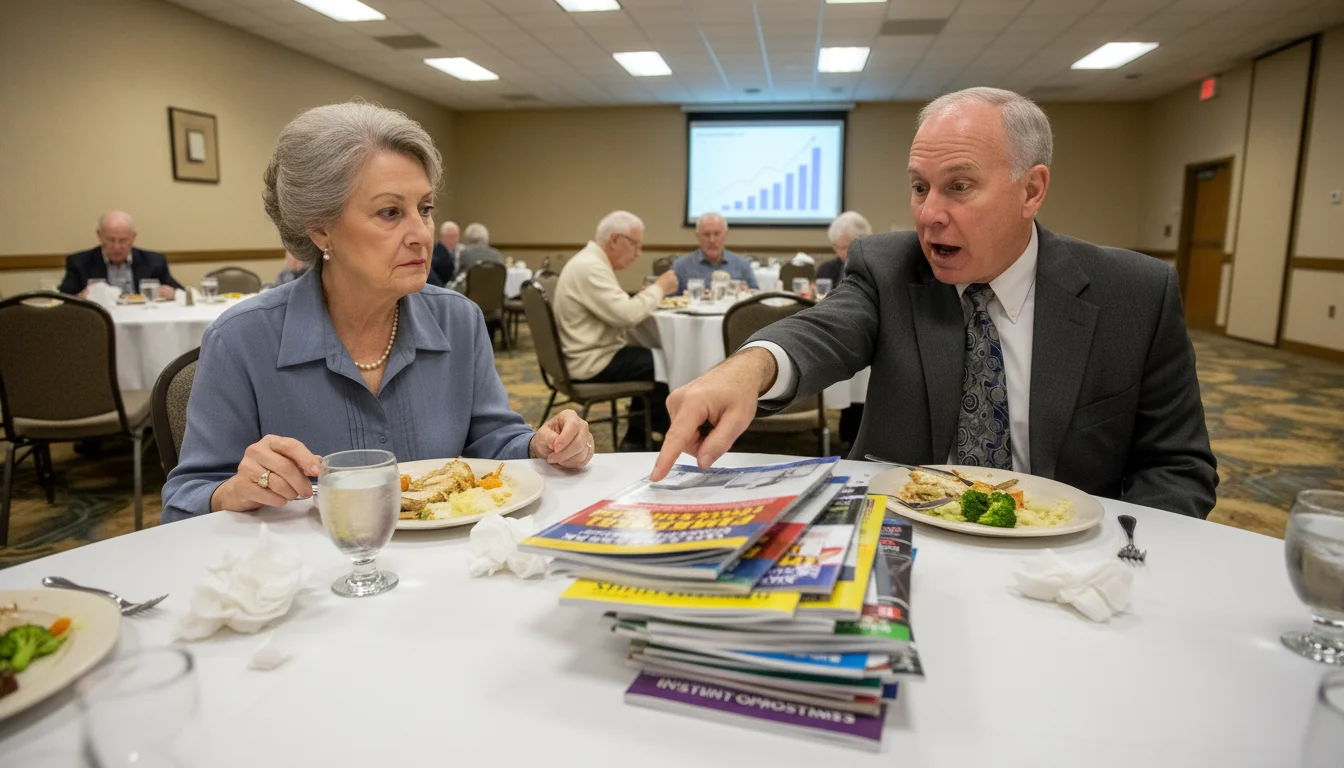

Scam 1: The “Free Lunch” Seminar with High-Pressure Sales

You receive an invitation in the mail for a free lunch or dinner at a local restaurant to learn about “new” long-term care or retirement strategies. While some of these seminars can be informative, many are high-pressure sales events for a single product, usually an expensive annuity or an unsuitable insurance policy. The presenter may create a sense of urgency, telling you an offer is only good for that day.

Red Flag: Any time someone pressures you to make a major financial decision on the spot. A legitimate advisor will encourage you to take the materials home, think about it, and discuss it with your family.

How to Protect Yourself: Enjoy the free meal, take the pamphlets, and say, “Thank you, I’ll review this at home.” Never sign any paperwork or provide financial details at one of these events. To protect yourself from scams and for consumer information, consult the Consumer Financial Protection Bureau (CFPB) and the FTC.

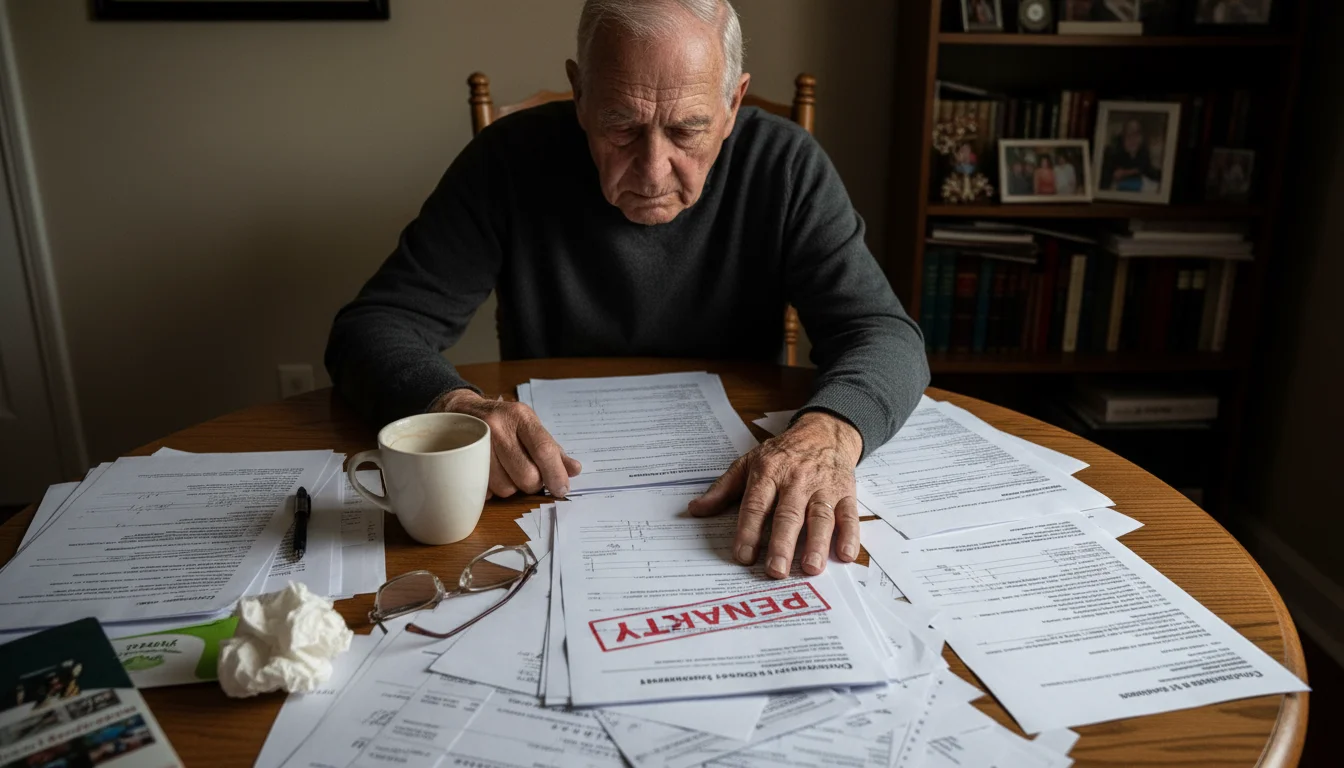

Scam 2: The Unqualified “Medicaid Planner”

These individuals or companies often use scare tactics, claiming the government is going to take your home. They promise to help you “hide” assets so you can qualify for Medicaid, often by selling you complex and expensive trusts or annuities. In many cases, their advice is poor or even illegal, and it can result in you being penalized by Medicaid and losing more money than you “protected.”

Red Flag: Anyone who isn’t a certified elder law attorney offering to do complex Medicaid planning. Be wary of anyone promising to “hide” your assets from the government.

How to Protect Yourself: If you are considering Medicaid planning, you must work with a qualified elder law attorney. They understand the intricate and ever-changing laws in your state and can provide legitimate advice.

Costly Mistake: Underestimating Inflation

This isn’t a scam, but it’s a common and costly mistake. When buying long-term care insurance, you may be tempted to decline the “inflation protection” rider to get a lower premium. This is almost always a bad idea. A daily benefit of $200 might seem adequate today. But 20 years from now, due to inflation, the actual cost of care could be closer to $400 per day. Without inflation protection, your policy will cover only half the cost.

Actionable Tip: Always choose a policy with some form of compound inflation protection, typically 3% or 5%. It will increase your premium, but it ensures your benefits will keep pace with the rising cost of care, which is the whole point of having the insurance in the first place.

—