Introduction: Taking Control of Your Finances in Retirement

Navigating your finances in retirement can feel like a full-time job. With a fixed income, every dollar counts, and making your money work harder for you is not just a smart strategy—it’s a necessity. For many, the words “credit card” can bring a sense of caution, often associated with debt and high interest rates. But what if you could transform this common financial tool into a source of savings and extra cash? When used responsibly, credit cards can be one of the most powerful ways to stretch your budget, earning you money back on the purchases you already make every day.

This guide is designed to demystify credit card rewards for seniors. We will not be talking about taking on debt. Instead, we will focus on a simple, powerful principle: using a credit card for your regular expenses and paying the balance in full every single month. By doing this, you avoid interest charges entirely and turn your spending on groceries, gas, and prescriptions into a steady stream of cashback or travel perks. Think of it as getting a small discount on everything you buy.

Our goal is to empower you with the knowledge to choose the right card for your lifestyle, use it strategically, and protect yourself from common pitfalls. By the end of this article, you will have clear, actionable steps to start maximizing your retirement rewards and adding a little extra cushion to your monthly budget. It’s about being a savvy consumer and making your financial habits work for you, not against you.

Understanding the Basics of Credit Card Rewards

Before you can start earning, it’s essential to understand the language of credit card rewards. The industry is filled with terms that can be confusing, but the core concepts are quite simple. Let’s break down the most important ones.

Key Reward Terms Defined

Cashback: This is the most straightforward type of reward. A cashback card gives you a percentage of your spending back as cash. For example, if you have a card that offers 2% cashback on all purchases and you spend $1,000 in a month, you earn $20. This can usually be redeemed as a statement credit (which lowers your bill), a direct deposit into your bank account, or a physical check.

Points or Miles: Instead of cash, some cards reward you with points or miles for every dollar you spend. These are most often associated with travel. For instance, you might earn 2 miles for every dollar spent on airline tickets. These points can then be redeemed for flights, hotel stays, or rental cars. While they can offer incredible value, they often require more effort to manage and redeem effectively.

Sign-Up Bonus: This is a large, one-time reward offered to new cardholders. A typical offer might be: “Earn $200 cashback after you spend $1,000 on purchases in the first 3 months.” These bonuses are a great way to jump-start your earnings, but only if the spending requirement fits your normal budget.

Annual Fee: Some rewards cards charge a yearly fee just for having the card, often ranging from $95 to over $500. These cards typically offer premium perks, such as airport lounge access or large annual travel credits. For most seniors on a fixed income, a card with no annual fee is the best and safest choice.

APR (Annual Percentage Rate): This is the interest rate you are charged if you carry a balance from one month to the next. High APRs are how credit card companies make most of their money. The fundamental rule of using rewards cards is to always pay your balance in full, making the APR irrelevant. If you pay even one dollar in interest, you are likely wiping out the value of the rewards you earned.

The Golden Rule: Pay Your Balance in Full

This point cannot be stressed enough. The entire strategy of earning credit card rewards hinges on one simple habit: paying off your statement balance in full every month. If you carry a balance, the interest you pay will quickly erase any rewards you’ve gained. Let’s look at a simple example:

Imagine you spend $1,500 in a month on a cashback card that earns 2% on everything. You’ve earned $30 in rewards ($1,500 x 0.02). However, if you only make the minimum payment and carry the remaining balance, your card’s 21% APR will start accumulating interest. On a $1,400 balance, you could be charged over $24 in interest for that month alone. Your net gain would be a mere $6, and if you continue to carry that balance, you will quickly find yourself losing money.

Rewards are a bonus for responsible credit use, not an incentive to spend more than you can afford. The goal is to profit from the system, not become a source of profit for the bank through interest payments.

Actionable Strategies for Maximizing Rewards in Retirement

Now that you understand the basics, let’s get practical. Choosing and using a rewards card effectively comes down to aligning it with your unique spending habits and lifestyle. Here are the most effective strategies for seniors.

Strategy 1: Match Your Card to Your Spending Habits

The best rewards card for you is the one that gives you the most back for how you already spend your money. Don’t change your habits to fit a card; find a card that fits your habits. The first step is to do a quick financial review.

Look at your bank and card statements from the last three to six months. Tally up your spending in major categories. For most retirees, these include:

- Groceries

- Gas and transportation

- Healthcare (prescriptions, co-pays)

- Dining out

- Utilities and phone bills

- Travel (visiting family, vacations)

Once you know where your money is going, you can find a card that rewards you generously in those areas. Let’s consider a few common retiree profiles:

The Home-Focused Spender: If most of your budget goes toward groceries, gas, and streaming services, look for a card that offers high cashback rates (like 3% to 6%) in these specific categories. Many no-annual-fee cards are designed exactly for this type of everyday spending.

The Traveler: If you frequently travel to visit grandchildren or explore new places, a travel rewards card could be a great fit. Look for one that offers bonus miles on flights and hotels. Some of these cards also come with valuable senior perks like trip cancellation insurance or free checked bags, which can easily save you more than the card’s annual fee, if it has one.

The Seeker of Simplicity: If you don’t want to track spending categories or juggle multiple cards, your best bet is a flat-rate cashback card. These cards offer a simple, consistent reward—typically 1.5% or 2%—on every single purchase, with no exceptions. This “set it and forget it” approach ensures you’re always earning without any extra effort.

Strategy 2: Prioritize No-Annual-Fee Cards

For the vast majority of people in retirement, a credit card with a $0 annual fee is the smartest choice. The rewards market is very competitive, and there are dozens of excellent no-fee cards that offer fantastic cashback rates and solid benefits. An annual fee creates a hurdle you have to overcome each year before you start actually earning a net profit. For example, a card with a $95 annual fee that earns 3% on groceries requires you to spend over $3,100 on groceries each year just to break even.

Only consider a card with an annual fee if you have done the math and are absolutely certain its unique benefits (like travel credits or airport lounge access) will provide you with value far exceeding its cost.

Strategy 3: Automate Everything for Peace of Mind

The key to stress-free credit card management is automation. As soon as you are approved for a new card, take these two steps:

Strategy 4: Redeem Your Rewards Regularly

Your rewards are your money, so don’t let them sit in your account indefinitely. Some reward programs have expiration dates, and hoarding points can lead to them losing value if the company changes its terms. Set a calendar reminder every three or six months to log in and redeem your rewards. For cashback, a statement credit is the easiest option. It directly reduces your next bill, putting money back into your budget with just a few clicks.

Financial Red Flags and Scams to Watch Out For

While credit cards offer great benefits, they are also a primary target for scammers. Being vigilant is your best defense. Scammers often target seniors with schemes designed to create panic and urgency. Here are some of the most common red flags and scams to be aware of.

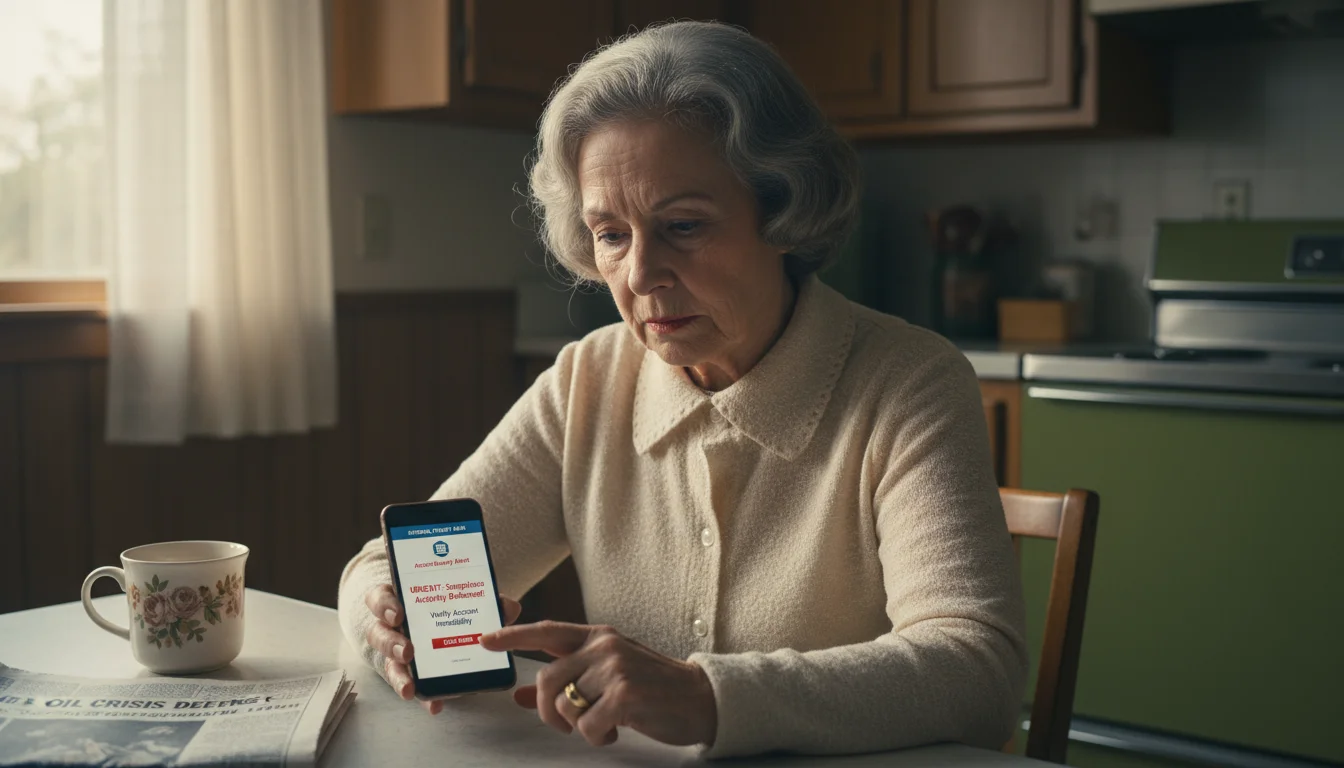

Scam 1: The Urgent “Account Security Alert” Phishing Scam

You receive an email or a text message that looks like it’s from your bank or credit card company. It might say something like, “Suspicious activity detected on your account” or “Your account has been locked for security reasons.” The message will demand that you click a link immediately to verify your identity or unlock your account. This is almost always a scam.

Warning Signs: The link will take you to a fake website that looks identical to your bank’s real site. When you enter your username and password, the scammers steal your login information. They may also ask for your full card number, expiration date, and security code.

How to Protect Yourself: Never, ever click on a link in an unsolicited email or text message about your financial accounts. If you are concerned, close the message and contact your bank directly. Either call the phone number on the back of your credit card or open a new browser window and type in the bank’s official website address yourself. To protect yourself from scams and for consumer information, consult the Consumer Financial Protection Bureau (CFPB) and the FTC.

Scam 2: The “Bonus Rewards” or “Interest Rate Reduction” Phone Call

The phone rings, and the caller claims to be from your credit card’s rewards department. They congratulate you on being a valued customer and offer you a special opportunity to earn bonus rewards or permanently lower your interest rate. All you need to do is “confirm” your personal details, including your full name, address, and, most importantly, your credit card number and the three-digit code on the back.

Warning Signs: A legitimate company will never call you out of the blue and ask for your full credit card number or security code. They already have that information. This is a tactic to get your details for fraudulent use.

How to Protect Yourself: Hang up immediately. If you are curious whether the offer was real, call your credit card company using the official number on your card. Do not trust the number provided by the caller or your phone’s caller ID, as these can be faked.

Financial Mistake: Chasing Rewards You Don’t Need

A common mistake is applying for a card with a huge sign-up bonus that requires you to spend thousands of dollars in a few months. If that spending amount is far more than your usual budget, you might be tempted to buy things you don’t need just to get the bonus. This is a trap. Overspending will always cost you more than the value of the rewards. Stick to cards with spending requirements that you can meet comfortably through your normal, everyday purchases.

A Financial Checklist for Choosing and Using a Rewards Card

Getting started with credit card rewards can be simplified into a few key actions. Follow this checklist to ensure you are making smart, secure, and profitable decisions for your retirement finances.

First, analyze your budget. Before you even start looking at cards, gather your bank and spending statements from the past few months. Understand exactly where your money goes. This is the most critical step, as it will tell you whether a card rewarding groceries, travel, or general spending is best for your personal financial situation.

Second, research and select the right card. Focus your search on cards with no annual fee. Use your spending analysis to find a card that offers the highest rewards in your top categories. A simple flat-rate cashback card is an excellent, worry-free choice for many retirees.

Third, set up your account for success. Once your card arrives, your first action should be to go online and enroll in automatic payments. Make sure to select the option to pay the “full statement balance” each month. This single step will protect you from late fees and costly interest charges.

Fourth, maximize your earnings without changing your lifestyle. Shift your regular, recurring bills (like utilities, phone, and insurance) to be paid automatically with your new rewards card. This allows you to earn rewards passively on expenses you already have.

Finally, make a habit of redeeming your rewards. Your rewards are your money, so don’t forget to use them. Set a reminder on your calendar for every few months to log into your account and redeem your accumulated cashback for a statement credit or a direct deposit. This keeps your budget healthy and ensures your efforts pay off.

Frequently Asked Questions

1. Will applying for a new credit card hurt my credit score?

Applying for a new card typically results in a “hard inquiry” on your credit report, which can cause your score to dip by a few points temporarily. However, this effect is minor and short-lived. Over the long term, using the card responsibly—by making on-time payments and keeping your balances low—will have a positive impact on your credit score by demonstrating a healthy credit history.

2. I’m on a fixed income. Are rewards cards really for me?

Absolutely. In fact, they can be even more valuable for someone on a fixed income. Since your budget is carefully planned, earning 2% to 5% back on essential purchases you already make, like groceries and prescriptions, is like giving yourself a small but consistent raise. It’s not about spending more; it’s about getting more value from the money you already spend.

3. Is it better to get cashback or travel points?

This depends entirely on your lifestyle. For most seniors, cashback is the superior choice because of its simplicity and flexibility. It can be used for anything, from lowering a bill to adding to savings. Travel points can offer higher value per point, but only if you travel regularly and are willing to navigate the complexities of airline and hotel loyalty programs. If you don’t travel at least a few times a year, stick with cashback.

4. How many credit cards should I have in retirement?

Simplicity is often the best policy in retirement. For most people, one or two well-chosen cards are more than enough. A great combination is a simple flat-rate 2% cashback card for all miscellaneous purchases, paired with a second card that offers a high reward rate (e.g., 3-5%) in your single biggest spending category, such as groceries.

5. What if I want to use cash or my debit card?

Using cash or a debit card is perfectly fine, but it’s important to know what you’re giving up. Credit cards offer superior fraud protection. If your credit card number is stolen and used fraudulently, you are typically not liable for any of the charges. If your debit card is compromised, the money is taken directly from your checking account, and it can be a much longer and more stressful process to get it back. Plus, with a debit card or cash, you are earning zero rewards on your purchases.

For official information on Social Security and Medicare, visit SSA.gov and Medicare.gov. Federal tax information is at the IRS.

Disclaimer: This article is for informational purposes and is not a substitute for professional financial or tax advice. Consult with a certified financial planner or tax professional for guidance on your specific situation.

For expert guidance on senior health and finance, visit Eldercare Locator, AARP and Alzheimer’s Association.

|

Fact-Checked Content

Our editorial team reviews all content for accuracy and updates it regularly. Learn about our editorial process →

|