Introduction: Taking Control of Your Finances in Retirement

Navigating your finances in retirement can feel like learning a new language. You’ve spent decades saving diligently, and now the focus shifts from accumulating wealth to making it last. One of the most important, and often misunderstood, concepts you will encounter is the Required Minimum Distribution, or RMD. Think of it as a rule set by the government that requires you to start withdrawing a certain amount from your tax-deferred retirement accounts each year once you reach a certain age.

Why does this rule exist? For years, the government allowed you to grow your money in accounts like a traditional IRA or 401(k) without paying taxes on it. The RMD is the government’s way of ensuring it eventually gets its tax revenue from that money. For you, understanding RMDs is not just about following a rule—it’s about managing your income, controlling your tax bill, and making smart decisions to protect the nest egg you worked so hard to build. Ignoring or mismanaging your RMDs can lead to significant penalties and unnecessary financial stress.

This guide is designed to demystify RMDs. We will walk you through what they are, how they work, and most importantly, provide you with actionable strategies to handle them wisely. By the end, you will feel more confident and empowered to manage this critical part of your retirement plan, ensuring your financial security for years to come.

Understanding the Financial Basics of RMDs

At its core, a Required Minimum Distribution is a mandatory annual withdrawal from certain retirement accounts. It’s not optional. Let’s break down the essential rules so you have a solid foundation.

Which Accounts Are Subject to RMDs?

The RMD rules apply to tax-deferred retirement accounts. This is where your contributions were made with pre-tax dollars, and the money grew without being taxed year after year. The most common types of accounts that require RMDs include:

- Traditional IRAs

- SEP IRAs

- SIMPLE IRAs

- 401(k) plans

- 403(b) plans

- 457(b) plans

- Profit-sharing plans

It’s equally important to know which accounts are not subject to RMDs for the original owner. The most significant of these is the Roth IRA. Because you funded your Roth IRA with after-tax dollars, the government does not require you to take distributions during your lifetime. This is a major advantage of Roth accounts in retirement. However, be aware that inherited Roth IRAs do have their own set of distribution rules for beneficiaries.

When Do You Have to Start Taking RMDs?

The starting age for RMDs has changed in recent years due to new legislation. Your RMD start date depends on your birth year:

- If you were born in 1950 or earlier, you were required to start your RMDs at age 72.

- If you were born between 1951 and 1959, your RMDs must begin at age 73.

- If you were born in 1960 or later, your RMDs will begin at age 75.

Your very first RMD must be taken by April 1 of the year after you reach your RMD age. For all subsequent years, the deadline is December 31. For example, if you turn 73 in 2024, your first RMD is for the 2024 tax year. You have until April 1, 2025, to take it. However, if you delay that first RMD until the following year, you will have to take two RMDs in one year—your first one (for 2024) and your second one (for 2025). Taking two distributions in a single year could push you into a higher tax bracket, so many financial advisors recommend taking your first RMD in the year you turn the required age.

How Is the RMD Amount Calculated?

The IRS calculates your RMD amount using a straightforward formula. It is your retirement account balance as of December 31 of the previous year, divided by a “distribution period” or “life expectancy factor” from the IRS Uniform Lifetime Table.

Let’s walk through a simple example:

Imagine your name is Robert, you are 75 years old, and the total value of your traditional IRAs on December 31, 2023, was $400,000.

So, Robert must withdraw at least $16,260.16 from his IRAs by December 31, 2024, to satisfy his RMD for the year. This withdrawn amount is then added to his other income for the year (like Social Security and pensions) and is taxed as ordinary income.

For official information on Social Security and Medicare, visit SSA.gov and Medicare.gov. Federal tax information is at the IRS.

Actionable Strategies and Money-Saving Tips

Simply knowing the RMD rules is just the first step. The real power comes from strategically managing your distributions to minimize taxes and make the process work for you. This is a key part of tax-efficient planning in retirement.

1. Consolidate Your Accounts for Simplicity

If you have multiple traditional IRAs, you must calculate the RMD for each one separately. However, you don’t have to take a withdrawal from each account. You can add up the total RMD amount required from all your IRAs and take that single, combined amount from just one of the IRA accounts. This simplifies paperwork and makes it easier to track.

Important Note: This rule applies to IRAs. For 401(k)s and other workplace retirement plans, the RMD must be calculated and taken from each plan separately. If you have an old 401(k) from a previous employer, you might consider rolling it over into a traditional IRA to simplify your RMD process.

2. Plan for the Tax Bite

Your RMD is taxable income. For many seniors on a fixed income, a large RMD can significantly increase their annual tax bill and even affect their Medicare premiums. You have two primary ways to handle the taxes:

- Have Taxes Withheld: You can ask your financial institution to automatically withhold a percentage of your RMD for federal (and state, if applicable) taxes, just like a paycheck. You might choose to withhold 10%, 20%, or another amount based on your estimated tax bracket. This is a simple, set-it-and-forget-it approach.

- Make Estimated Tax Payments: If you prefer to receive the full RMD amount, you can pay the taxes yourself through quarterly estimated payments to the IRS. This requires more active management but gives you more control over your cash flow during the year.

3. Use a Qualified Charitable Distribution (QCD)

If you are charitably inclined and are age 70.5 or older, the Qualified Charitable Distribution is one of the most powerful tax-efficient planning tools available. A QCD allows you to donate up to $105,000 (for 2024, and this amount is indexed for inflation) directly from your IRA to a qualified charity.

Here’s why it’s so beneficial: The amount you donate via a QCD counts toward your RMD for the year, but it is excluded from your taxable income. This is much better than taking the RMD, paying taxes on it, and then donating the after-tax amount.

Example: Let’s go back to Robert, whose RMD is $16,260. If Robert donates $10,000 directly from his IRA to his favorite charity, that $10,000 is not counted as income for him. He would then only need to withdraw the remaining $6,260 to satisfy his RMD, and only that smaller amount would be taxed. The QCD lowered his taxable income by $10,000.

4. Don’t Wait Until the Last Minute

The deadline for most RMDs is December 31, but waiting until the last week of the year is a risky strategy. Financial institutions are swamped, markets can be volatile, and a simple mistake could cause you to miss the deadline. A missed deadline comes with a steep penalty—25% of the amount you failed to withdraw (which can be reduced to 10% if you correct the mistake in a timely manner). It’s far better to plan your RMD withdrawal earlier in the year or set up an automatic withdrawal plan with your brokerage firm.

5. Consider a Roth Conversion Before RMD Age

This is a more advanced strategy that must be done before you reach RMD age, but it’s worth knowing about. A Roth conversion involves moving money from a traditional IRA to a Roth IRA. You have to pay income taxes on the amount you convert in the year you do it. While this means a tax bill today, the money in the Roth IRA then grows tax-free forever and is not subject to RMDs during your lifetime. For those who expect to be in a similar or higher tax bracket in the future, converting some funds to a Roth in their 60s can reduce the balance of their traditional retirement accounts, thereby lowering their future RMDs and overall tax burden in their 70s and 80s.

Financial Red Flags and Scams to Watch Out For

Where there is money, there are unfortunately mistakes and scams. When it comes to RMDs, being vigilant can protect you from costly errors and fraudulent schemes. Here are a few red flags to keep on your radar.

Mistake 1: Forgetting About Old Retirement Accounts

One of the most common and costly mistakes is simply forgetting about an old 401(k) or 403(b) from a job you left decades ago. Out of sight can truly mean out of mind. However, the IRS does not forget. You are responsible for taking an RMD from every single one of your tax-deferred retirement accounts. Forgetting one means you will fail to take your full required distribution, triggering that harsh penalty. It’s a great practice to consolidate old workplace accounts into a single IRA to make tracking them easier.

Mistake 2: The Aggregation Error

As mentioned earlier, you can add up the RMDs for all your traditional IRAs and take the total from just one IRA. However, this rule does not apply between different types of accounts. You cannot take an RMD required from a 401(k) out of an IRA, or vice versa. The RMD for a 403(b) must come from a 403(b) account. Confusing these rules can lead to a penalty for not taking the proper distribution from the correct account type, even if you withdrew the right total amount.

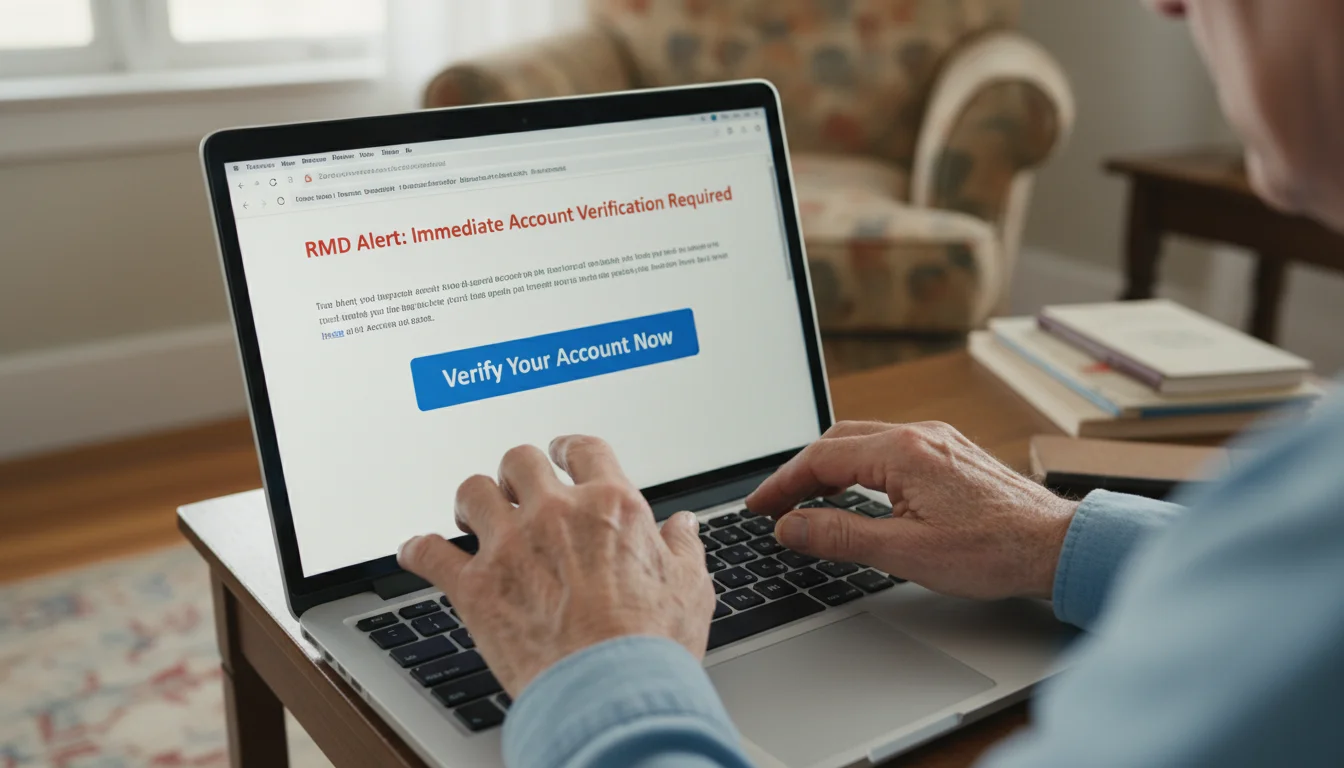

Scam Alert: The “RMD Problem” Phishing Scam

Scammers know that RMDs can be a source of anxiety for seniors. They exploit this by sending urgent-sounding emails or making phone calls pretending to be from the IRS or your brokerage firm. The message might say something like, “Warning: Your RMD calculation is incorrect. Click here to verify your account immediately or face penalties.”

This is a classic phishing scam designed to get you to click a malicious link or provide your login credentials and personal information. Remember, the IRS will never initiate contact with you by email, text message, or social media to request personal or financial information. Your financial institution may send you RMD reminders, but they will not ask for your password or full account number in an email. If you receive a suspicious message, do not click any links. Instead, contact your financial institution directly using the phone number on your account statement or their official website.

To protect yourself from scams and for consumer information, consult the Consumer Financial Protection Bureau (CFPB) and the FTC.

A Financial Checklist for RMDs

Managing your RMDs each year doesn’t have to be overwhelming. Following a simple checklist can keep you on track and ensure you meet all requirements without stress. Here is a step-by-step guide to follow annually.

First, identify all your retirement accounts. Early in the year, make a list of every traditional IRA, SEP IRA, SIMPLE IRA, 401(k), and 403(b) you own. Don’t forget any old workplace plans you may have left behind. Confirm you have the most recent statements for each one.

Second, find the previous year-end balance for each account. Your RMD for the current year is based on the account value on December 31 of last year. This number should be clearly stated on your year-end statement from your financial institution.

Third, calculate your RMD for each account. You can do this yourself using the IRS Uniform Lifetime Table or, more easily, ask your financial institution. Most custodians calculate the RMD amount for you as a courtesy and include it on your statements or online portal. Verify their calculation for your own peace of mind.

Fourth, create a withdrawal plan. Decide how and when you will take the distribution. Will you take it as a lump sum? In monthly installments? Will you have taxes withheld? Will you use a QCD for a charitable donation? Set up your plan well before the end of the year to avoid the December rush.

Fifth, execute your plan and keep records. Once you take your distribution, keep a record of the transaction. Note the date, the amount withdrawn, and any taxes that were withheld. Store this confirmation with your tax documents for the year. This simple process will ensure you never miss a beat.

Frequently Asked Questions

Even with a good understanding of the basics, specific situations can raise questions. Here are answers to some of the most common questions seniors have about RMD rules.

1. I’m still working past my RMD age. Do I still have to take an RMD from my current employer’s 401(k)?

There is a helpful exception here. If you are still working for the company that sponsors your 401(k) and you do not own more than 5% of the company, you can typically delay taking RMDs from that specific 401(k) plan until you retire. However, this “still working” exception does not apply to traditional IRAs or 401(k)s from previous employers. You must still take RMDs from those accounts on schedule.

2. Do I have to take RMDs from my Roth IRA?

No. As the original owner of a Roth IRA, you are never required to take RMDs. The money can stay in the account and continue to grow tax-free for as long as you live. This is a significant advantage for estate planning, as it allows you to pass on a larger tax-free inheritance. Beneficiaries who inherit a Roth IRA, however, will usually be required to take distributions.

3. What happens if I inherit an IRA? Do I have to take RMDs?

Yes, the rules for inherited IRAs are very complex and depend on your relationship to the deceased and when they passed away. For most non-spouse beneficiaries who inherited an IRA after 2019, the entire account balance must be withdrawn by the end of the 10th year following the original owner’s death. There are no annual RMDs during this 10-year period, but the full amount must be out by the deadline. Spouses have more flexible options, including the ability to roll the inherited IRA into their own. Because these rules are so nuanced, it is highly recommended to consult a financial professional.

4. Can I just reinvest my RMD back into my IRA?

No, you cannot. An RMD is a permanent distribution. Once you withdraw the money from your tax-deferred retirement account, it cannot be rolled back into that IRA or another retirement account. You can, of course, invest the money in a regular, taxable brokerage account after you’ve paid the necessary taxes on the distribution, but it cannot go back into a tax-advantaged retirement plan.

5. What if I don’t need the money from my RMD?

This is a common situation for retirees with other sources of income. Even if you don’t need the funds for living expenses, you still must take the distribution. The key is to have a plan for that money. As mentioned, you could use a QCD to donate it, use it to pay your estimated taxes for the year, reinvest it in a taxable account, give it as a gift to family members (within annual gift tax exclusion limits), or use it for a special purchase like a vacation or home improvement project.

Disclaimer: This article is for informational purposes and is not a substitute for professional financial or tax advice. Consult with a certified financial planner or tax professional for guidance on your specific situation.

For expert guidance on senior health and finance, visit National Institutes of Health (NIH), Centers for Medicare & Medicaid Services (CMS), Social Security Administration (SSA), Consumer Financial Protection Bureau (CFPB) and Administration for Community Living (ACL).

|

Fact-Checked Content

Our editorial team reviews all content for accuracy and updates it regularly. Learn about our editorial process →

|