Actionable Strategies and Money-Saving Tips

Choosing between these two paths is a personal decision that depends entirely on your health, finances, and lifestyle. Here are the concrete steps to take to make the right choice for you.

Step 1: Assess Your Personal Needs and Budget

Before you even look at plans, you need to take stock of your situation. Get out a notepad and write down the answers to these questions:

- Your Health: Do you have chronic conditions? What specialists do you see regularly? Are you in good health now but want protection against future risks?

- Your Doctors: Is it important for you to keep your current doctors? Make a list of every physician, specialist, and hospital you want to continue using.

- Your Prescriptions: List every medication you take, including the dosage and frequency. This is one of the most critical factors for controlling costs.

- Your Budget: How much can you comfortably afford for monthly premiums? A higher premium might mean lower out-of-pocket costs when you need care, and vice-versa. Are you more comfortable with predictable monthly costs (like with a Medigap plan) or lower premiums with potentially variable copays (like with a Medicare Advantage plan)?

- Your Lifestyle: Do you travel frequently within the U.S.? If so, the nationwide coverage of Original Medicare and a Medigap plan might be more suitable than a regional Medicare Advantage network.

Step 2: Understand Your Enrollment Deadlines

Missing an enrollment deadline can result in lifelong late-enrollment penalties, so this is critical. The most important period is your Initial Enrollment Period (IEP). This is a 7-month window that starts 3 months before the month you turn 65, includes your birthday month, and ends 3 months after the month you turn 65. This is your primary window to sign up for Parts A and B, as well as a Part D or Medicare Advantage plan, without penalty.

If you miss your IEP, your next chance is the General Enrollment Period (January 1 to March 31 each year), but your coverage will not start until July 1, and you may face penalties. Each fall, from October 15 to December 7, is the Annual Open Enrollment Period, where you can switch between Original Medicare and Medicare Advantage, or change your Part D or Advantage plan.

Step 3: Directly Compare the Two Paths

Now, use your personal assessment from Step 1 to weigh the pros and cons.

Choose Original Medicare + Medigap + Part D if:

- You want the maximum freedom to choose your doctors and hospitals without worrying about networks.

- You travel often within the U.S. and want coverage everywhere.

- You prefer predictable monthly costs and want to minimize surprise bills for deductibles and coinsurance.

- You are willing to pay higher total monthly premiums for this stability and flexibility.

Choose a Medicare Advantage (Part C) plan if:

- You want the simplicity of an all-in-one plan with a single card.

- You are looking for the lowest possible monthly premiums.

- Your preferred doctors and hospitals are already in the plan’s network.

- You want extra benefits like dental, vision, and hearing coverage included.

- You are comfortable with managed care rules, like getting referrals to see specialists or prior authorization for certain procedures.

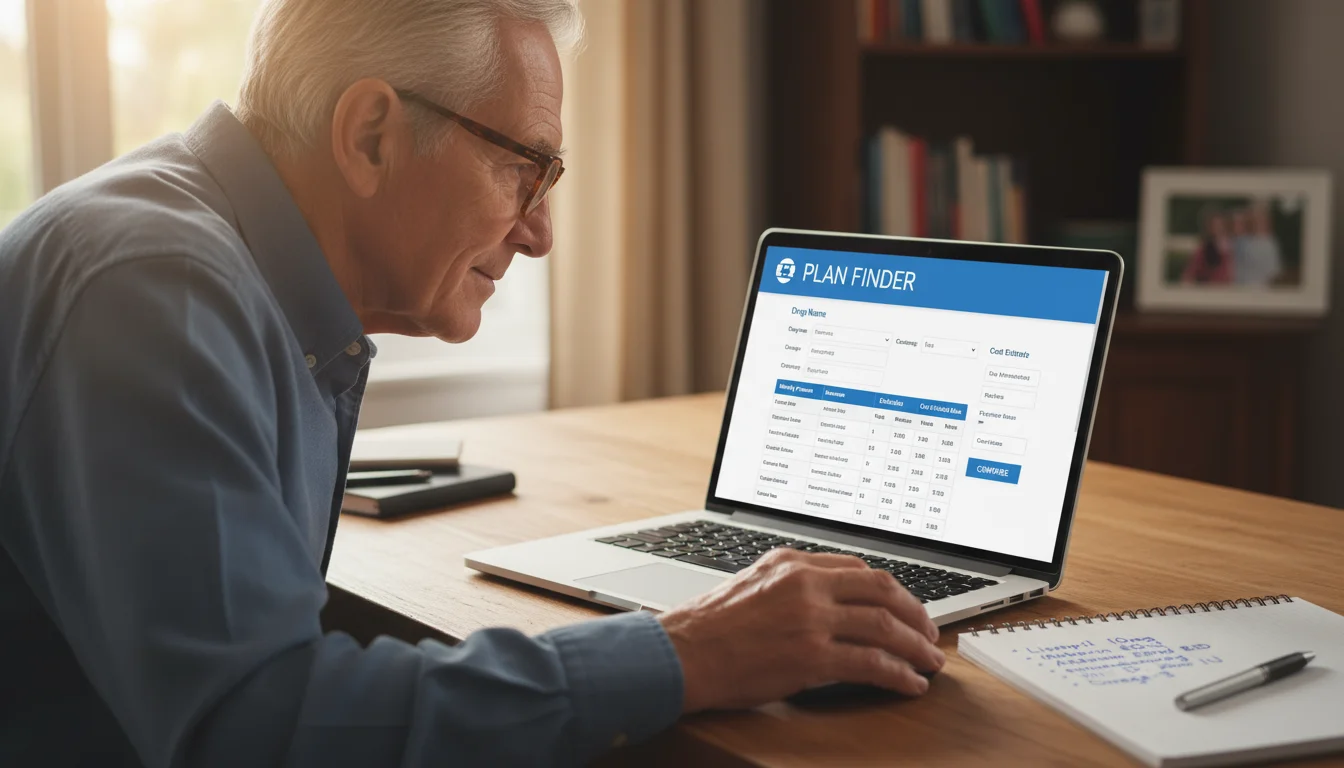

Step 4: Use Official Tools to Find and Compare Plans

Never rely on marketing mailers alone. The single most powerful tool at your disposal is the official Plan Finder tool on the federal government’s website. For official information on Social Security and Medicare, visit SSA.gov and Medicare.gov. On the Medicare website, you can enter your zip code, the list of prescription drugs you made in Step 1, and your preferred pharmacy. The tool will then show you all the available Part D and Medicare Advantage plans in your area and estimate your total annual costs for each one, including premiums, deductibles, and drug copays. This allows you to do a true apples-to-apples comparison based on your specific needs.